Variable Costing

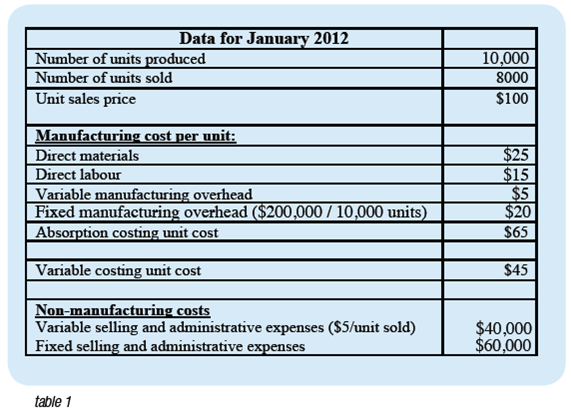

An example of an using variable and absorption costing Variable costing is a cost concept. Under this method, is incurred in the period that a product is produced. This addresses the issue of that allows to rise as rises.

Under an absorption cost method, management can push forward costs to the next period when products are sold. This artificially inflates profits in the period of production by incurring less cost than would be incurred under a variable costing system. Variable costing is generally not used for external reporting purposes. Under the, must use absorption costing to comply with. Variable costing is a costing method that includes only variable manufacturing costs—direct materials, direct labor, and variable manufacturing overhead—in unit product costs. References.

Recall from financial accounting that the objective of a business is to earn an profit and add value to the company. When a company generates profit, value is added to a company (assuming it is not all distributed as dividends). External users obtain their information from GAAP financial statements.

While managers -the internal users-need more information than what is reported externally. Not only do managers need to know the amount of profit, but also what contributes to the profit and how to use that information to predict future profitability. As a result of the two different needs, there are two cost accumulation methods and two formats of income statements, both of which classify costs differently. This chapter examines both of those-one for external reporting and the other for internal use by managers. Both recognize income based on the a ccrual basis of accounting in which revenue is recognized in the period earned and expenses (costs) are recognized when incurred. Absorption Costing versus Variable Costing There are two cost accumulation methods of determining product costs.

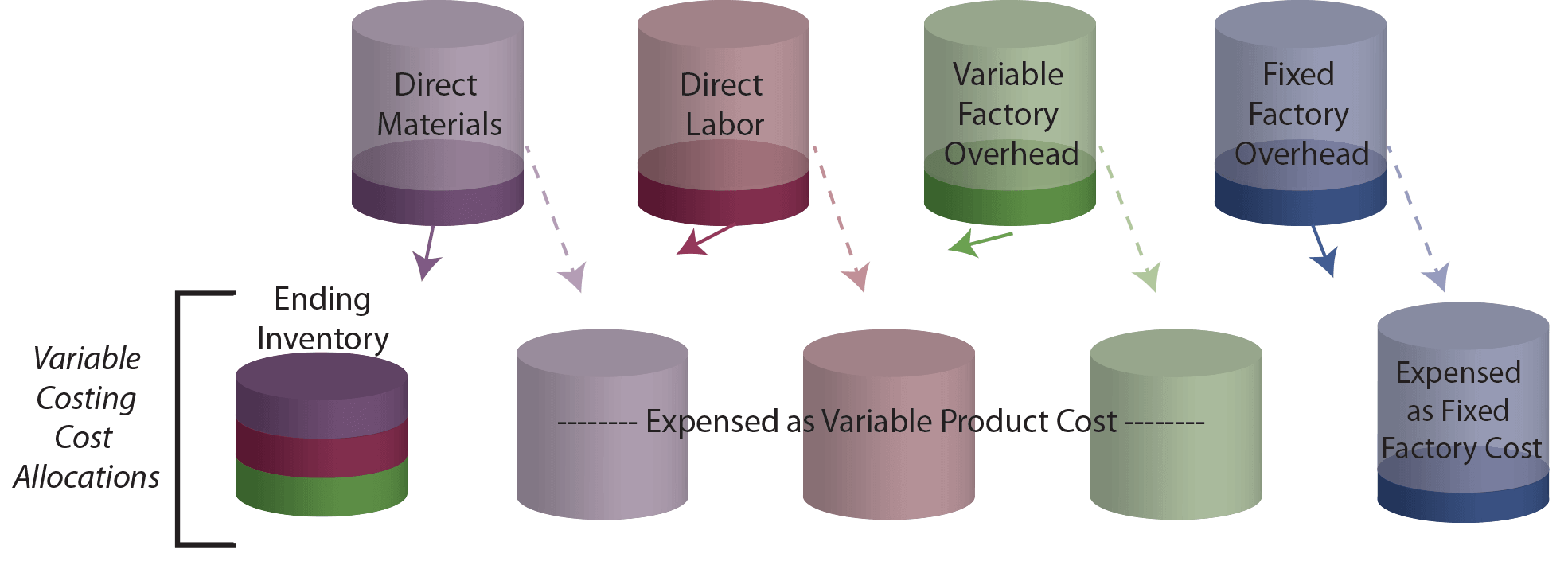

You already know that product costs for a manufacturing company consist of direct materials, direct labor, and manufacturing overhead (fixed and variable) costs. Absorption costing, also known as full costing, is the process in which all of these costs are classified as product costs. This is the method you used in financial accounting when preparing financial statements because GAAP requires that the full cost of products be reported as product costs in the financial statements. Conceptually, the matching principle underlies this method which requires that expenses should be matched against the revenue they helped generate by reporting in the same period as revenues earned. Absorption costing separates costs based on cost function-product versus period classifications.

Note that product costs are often referred to as inventoriable costs. For internal accounting purposes, managers use variable costing which treats only materials, labor and variable manufacturing overhead as product costs. Fixed manufacturing overhead costs are treated as period costs, and expensed in the period incurred. The underlying rationale of this approach is that in order to make predictions about costs, you must separate them based on behavior-fixed or variable. Variable costing is not considered GAAP, but is very useful for management for decision making purposes. The only difference between absorption costing and full costing is how fixed manufacturing overhead costs are treated. Absorption (Full) Costing Income Statement Product costs are labeled as cost of goods sold on the income statement under absorption costing and include all manufacturing costs of inventory units sold-direct materials, direct labor, and variable manufacturing overhead costs.

Variable Costing Income Statement Example

All non-product costs incurred by a company are reported as period costs, and are usually labeled as operating expenses on the income statement. To illustrate, assume Wilkes, Inc. Earned $50,000 of revenue by producing and selling 10,000 staplers during 2017, and incurred the following total costs. Variable manufacturing costs $14,000 Variable operating costs 12,000 Fixed manufacturing costs 8,000 Fixed operating costs 6,000 The inventoriable cost (product cost) under full costing is $22,000 which includes the variable manufacturing costs of $14,000 and the fixed manufacturing cost of $8,000. This total amount is expensed in the same period during which the inventory is sold. In preparing an income statement under the full costing method, costs are reported based on their function, i.e., product versus period.

Revenue is always reported first on an income statement. While product costs appear next on the multiple step income statement, the 'product' label is not used on the income statement. Rather, product costs on the income statement are labeled as cost of goods sold. Cost of goods sold includes both fixed and variable products costs: $14,000 and $8,000. Period costs are labeled as operating expenses on the income statement, and include both fixed and variable period costs: $12,000 + $6,000 = $18,000. Full Costing Income Statement Year Ending December 31, 2017 Sales revenue $50,000 Cost of goods sold: Variable manufacturing costs $14,000 Fixed manufacturing costs 8,000 22,000 Gross profit (gross margin) 28,000 Operating expenses: Variable operating costs 12,000 Fixed operating costs 6,000 Operating expenses 18,000 Net operating income $10,000 Gross margin is the amount available to cover fixed costs and to go towards profit. For this example, the company has $24,000 available to cover fixed costs and to go towards profit.

Gross profit per unit, often called unit gross margin, is the amount the sale of each unit contributes to covering operating expenses and profit. The unit gross margin is $28,000 divided by 10,000 staplers, or $2.80 per stapler. N et operating income is a generic term often used to imply that profit arises from routine operating activities. We use this label to imply that income taxes have not yet been considered as well. It is common to refer to this term as simply 'profit.' The g ross margin ratio (GPR), often known as the gross profit ratio, is e xpressed as a percentage of sales.

This is the same ratio as discussed in your financial accounting course. You can calculate it based on total amounts as shown on the income statement (for all units sold), or using the unit cost and unit selling price. The percentage answer is the same regardless. GPR = Gross margin amount in dollars Sales revenue in dollars The GPR m easures how many cents out of each sales dollar are available to cover operating expenses and to contribute to profit. It is expressed as a percentage with two decimal places displayed: xx.xx%.

This amount is not reported on the income statement. V ariable Costing Income Statement Product costs are labeled as variable manufacturing costs on the income statement and include only the variable manufacturing costs of inventory units sold-direct materials, direct labor, and variable manufacturing overhead costs. All non-product costs incurred by a company are reported as period costs, and are usually labeled separately as fixed manufacturing costs and fixed and variable operating expenses on the income statement.

Assume again that Wilkes, Inc. Earned $50,000 of revenue by producing and selling 10,000 staplers during 2017, during which the same total costs were incurred as follows. Variable manufacturing costs $14,000 Variable operating costs 12,000 Fixed manufacturing costs 8,000 Fixed operating costs 6,000 The inventoriable cost (product cost) under variable costing is $14,000 which includes only variable manufacturing costs.

This amount is expensed in the same period during which the inventory is sold. In preparing an income statement under the variable costing method, product costs are separated based on behavior, i.e., variable versus fixed. Product costs consist only of variable manufacturing costs.

Fixed manufacturing costs are reported as period costs. Variable Costing Income Statement Year Ending December 31, 2017 Sales revenue $50,000 Variable costs: Variable manufacturing costs $14,000 Variable operating costs 12,000 26,000 Contribution margin 24,000 Fixed costs: Fixed manufacturing costs 8,000 Fixed operating costs 6,000 14,000 Net operating income $10,000 Contribution margin is the amount available to cover fixed costs and to go towards profit. For this example, the company has $24,000 available to cover fixed costs and to go towards profit. Contribution margin per unit is the amount the sale of each unit contributes to covering fixed costs and contributing to profits. The unit gross margin is $24,000 divided by 10,000 staplers, or $2.40 per stapler. The c ontribution margin ratio (CMR) is expressed as a percentage of sales.

It can be calculated based on total amounts for all units produced and sold, or for a single unit. The percentage answer is the same regardless. CMR = Contribution margin amount in dollars Sales revenue in dollars The CMR m easures how many cents out of each sales dollar that are available to cover fixed costs and to contribute to profit. It is expressed as a percentage with two decimal places displayed: xx.xx%. As with other ratios, t his amount is not reported on the income statement. Reporting on the Balance Sheet The only difference in reporting inventories for a manufacturing company on the balance sheet is the inclusion or exclusion of fixed manufacturing overhead costs.

Product Costs under Absorption Costing Product costs under absorption costing include direct materials, direct labor, and both fixed and variable manufacturing overhead costs, and are categorized as a current asset on the balance sheet. They are either labeled as Raw Materials inventory, Work In Process Inventory, or Finished Goods Inventory, depending on the degree of completion, or quite often, the three totals are grouped together and labeled simply as Inventory.

Only the cost of unsold inventory units is reported on the balance sheet. Product Costs under Variable Costing Product costs under absorption costing include direct materials, direct labor, and variable manufacturing overhead costs, and are categorized as a current asset on the balance sheet. The labeling of inventoriable costs on the balance sheet is the same as used under absorption costing. As with absorption costing, only the cost of unsold inventory units is reported on the balance sheet. Non-Product Costs Under both absorption and variable costing, any non-product costs that provide future economic benefits are reported as prepaid items, plant assets, etc. In the assets section of the balance sheet based on the respective type of unused cost. Effects on Variable and Absorption Costing Whenever the number of units produced and the number of units sold are equal, income will be the same regardless if the variable costing or the absorption costing approach is used.

When the number of units sold differs from the number produced during the period, a timing difference occurs due to when the fixed manufacturing overhead costs are expensed. When the timing of an expense changes, income changes. This occurs because a portion of the fixed manufacturing overhead costs are reported as inventory on the balance sheet under absorption costing, while all fixed manufacturing costs are expensed in the period incurred under variable costing.

The timing difference affects the balance sheet as well because inventory on the balance sheet includes a portion of the fixed manufacturing overhead relating to the units unsold under absorption costing, while no fixed manufacturing overhead is reported as part of inventory under variable costing. Exhibit 1 compares the inventory valuation and income effects under absorption and variable costing.

Exhibit 1- Inventory Valuation and Income Effects of Absorption and Variable Costing Walk Through Problem #1 - When Production Volume Equals Sales Volume Vetter, Inc. Produced and sold 4,000 door locks during 2017. Unit information follows. Sale revenue per unit $36 Variable operating costs per unit 2 Variable manufacturing costs per unit 12 Total fixed operating costs 24,000 Total fixed manufacturing costs 32,000 Prepare income statements under both the variable and full costing methods. Calculate and interpret the following amounts for Vetter, Inc.:.

Contribution margin per unit. Total contribution margin. Contribution margin ratio. Gross margin per unit. Total gross margin.

Gross margin ratio Solution Income statement using variable costing. Sales revenue (4,000 x $36) $144,000 Cost of goods sold: Variable manufacturing costs(4,000 x $12) $48,000 Fixed manufacturing costs 32,000 80,000 Gross margin 64,000 Operating expenses: Variable operating costs(4,000 x $2) 8,000 Fixed operating costs 24,000 32,000 Net operating income $ 32,000 Net operating income is $32,000 under full absorption costing. Key point: Net operating income is the same under both variable and full costing when the number of units produced equals the number of units sold. Note also that the dollar amount of gross margin appears on the GAAP full costing income statement, and the dollar amount of contribution margin appears on the variable costing income statement. Neither of the two 'ratios' (gross margin ratio or contribution margin ratio) appears on either income statement. Contribution margin per unit C ontribution margin per unit is the difference between the unit selling price and the unit variable cost: Unit contribution margin = Sales price per unit - Variable cost per unit = $36 - ($12 + $2) = $22 per unit Each unit sold by Vetter generates $22 to cover fixed costs and to contribute to profit.

Total contribution margin Given that 4,000 units were produced and sold and each generated $22 of contribution (from part 1), the total contribution margin is: Total contribution margin = Unit contribution margin x Units = $22 x 4,000 = $88,000 Note that this amount is reported on the variable costing income statement. Vetter has $88,000 available to cover fixed costs and contribute to profits during the period. Contribution margin ratio The c ontribution margin ratio is calculated by dividing the contribution margin per unit by the selling price per unit. The same answer results whether the ratio is calculated using one unit or totals for all units produced and sold for the period. Contribution margin ratio = (Contribution margin per unit - Variable cost per unit ) = ($36 - $14) / $36 = 61.11% OR = ($22 x 4,000) / ($36 x 4,000) = 61.11% Each dollar of sales revenue generates about 61 cents to cover fixed costs and to contribute to profit. Gross margin per unit The difference between product cost is called gross margin per unit.

Unit gross margin = Sales price per unit - Product cost per unit = $36 - ($12 + ($32,000/4,000) = $16 per unit Each unit sold generates $16 to cover operating costs and to contribute to profit. Total gross margin The difference between the total sales revenue at a particular level of activity and the total product cost at the same level is called total gross margin.

Manufacturing costs per unit include both the variable and fixed costs: $12 + ($32,000/4,000) = $20 Total contribution margin = Sales revenue - Product costs = ($36 x 4,000) - ($20 x 4,000) = $64,000 Note that this amount is reported on the absorption costing income statement. Vetter has $64,000 available to cover operating costs and contribute to profits during the period. Gross margin ratio Gross margin per unit divided by selling price per unit generates the gross margin ratio.

The same answer results whether the ratio is calculated using one unit or totals for the period. Gross margin ratio = ($36 - $20) / $36 = 44.44% Each dollar of sales generates about 44 cents to cover operating costs and to contribute to profit. Walk Through Problem #2 - When Production Volume Exceeds Sales Volume Vetter, Inc. Produced 4,000 and sold 3,900 door locks during 2017. The company had 80 door locks in inventory on January 1, 2017. Unit information follows.

Sale revenue per unit $ 36 Variable operating costs per unit 2 Variable manufacturing costs per unit 12 Total fixed operating costs 24,000 Total fixed manufacturing costs 32,000 Prepare income statements under both the variable and full costing methods. Determine Finished Goods inventory reported on the balance sheet at the end of 2017. Solution Income statement using variable costing The number of units used on the income statement for revenue and variable costs is based on the units sold for the year. Sales revenue (4,000 x $36) $144,000 Variable costs: Variable manufacturing costs (4,000 x $12) $48,000 Variable operating costs (4,000 x $2) 8,000 56,000 Contribution margin 88,000 Fixed costs: Fixed manufacturing costs 32,000 Fixed operating costs 24,000 56,000 Net operating income $ 32,000 Net operating income is $32,000 under variable costing. The variable costing income statement is the same regardless if the units produced differs from units sold or not. Income statement using full costing Manufacturing fixed costs must be prorated between units produced that are sold and those not sold.

The total manufacturing fixed cost for all units produced is $32,000. This cost is divided by the number of units produced to determined the fixed manufacturing cost per unit: $32,000 / 4,000 = $8.00 per unit The portion of fixed manufacturing costs related to the units produced and sold during the period is expensed in the current period: $8.00 x 3,900 units = $31,200 The portion of fixed manufacturing costs related to the units produced but not sold during the period remain as part of inventory on the balance sheet. Sales revenue (4,000 x $36) $144,000 Cost of goods sold: Variable manufacturing costs (4,000 x $12) $48,000 Fixed manufacturing costs 31,200 79,200 Gross margin 64,800 Operating expenses: Variable operating costs (4,000 x $2) 8,000 Fixed operating costs 24,000 32,000 Net operating income $ 32,800 Net operating income is $32,800 under absorption costing. Because more units were produced than sold, absorption costing income exceeds variable costing income. Key point: Net operating income is greater under absorption costing when the number of units produced exceeds the number of units sold. Ending inventory under variable costing Because the units of inventory are complete, they are considered to be Finished Goods inventory.

A T-account is useful to determine the number of units remaining in inventory at yearend. Finished Goods in Units 80 4,000 3,900 180 The unit cost of each finished door knob includes only the variable manufacturing costs, $12 per unit.

Finished goods inventory is reported on the balance sheet as $12 times 180 units, a total of $2,160 under variable costing. Ending inventory under absorption costing The number of units in Finished Goods inventory is the same under variable and absorption costing, which is 180 units. The unit cost of each finished door knob includes the full manufacturing cost including both variable and fixed manufacturing costs. Fixed manufacturing costs were previously calculated based on the number of units produced: $32,000 / 4,000 = $8.00 per unit The product cost under absorption costing includes the $8.00 fixed manufacturing cost along with the variable manufacturing cost of $12 per unit, for a total of $20.00 per unit. Finished goods inventory is reported on the balance sheet as $20 times 180 units, a total of $3,600 under absorption costing. Walk Through Problem #3 - When Production Volume Is Less Than Sales Volume Vetter, Inc.

Proppfrexx onair keygen for mac. Radio42 - ProppFrexx ONAIR - The Playout and Broadcast Automation Solution. You might use Parallels Desktop for Mac to run ProppFrexx ONAIR on Apple. Feb 24, 2018 - ProppFrexx ONAIR serial numbers, cracks and keygens are presented here. Patch).patch-SND keygen crack instant download ProppFrexx. Verified for compatibility with Windows OS, MAC OS and *nix systems like Linux. Aug 22, 2017 - Found 5 results for proppfrexx onair 3.0 x universal patch patch snd zip.using proppfrexx onair crack, key.proppfrexx onair. Snd keygen and crack were.download proppfrexx onair v4.0. Free tropical wallpaper for mac. Proppfrexx onair keygen mac - Download ProppFrexx ONAIR at Free Download 64. Jan 28, 2018 - ProppFrexx ONAIR Keygen - DOWNLOAD (Mirror #1).

Produced 4,000 and sold 4,050 door locks during 2017. The company had 80 door locks in inventory on January 1, 2017. Unit information follows. Sales revenue (4,050 x $36) $145,800 Variable costs: Variable manufacturing costs (4,050 x $12) $48,600 Variable operating costs (4,050 x $2) 8,100 56,700 Contribution margin 89,100 Fixed costs: Fixed manufacturing costs 32,000 Fixed operating costs 24,000 56,000 Net operating income $ 33,100 Net operating income is $33,100 under variable costing.

Because only variable manufacturing costs are considered product costs, the entire fixed manufacturing cost appears on the income statement as a period cost. Income statement using absorption costing Manufacturing fixed costs must again be prorated between units produced that are sold and those not sold. The fixed manufacturing cost is still $8.00 per unit because the number of units produced is still 4,000 units. $32,000 / 4,000 = $8.00 per unit The portion of fixed manufacturing costs related to the units produced and sold during the period is expensed in the current period: $8.00 x 4,050 units = $32,400. Sales revenue (4,050 x $36) $145,800 Cost of goods sold: Variable manufacturing costs (4,050 x $12) $48,600 Fixed manufacturing costs 32,400 81,000 Gross margin 64,800 Operating expenses: Variable operating costs (4,050 x $2) 8,100 Fixed operating costs 24,000 32,100 Net operating income $ 32,700 Net operating income is $32,700 under absorption costing. Because fewer units were produced than sold, absorption costing income is less than variable costing income.

Note that we are assuming the unit fixed manufacturing cost of units in the beginning inventory are the same as those produced during the period. Had these two amounts differed, you would need to track the cost of the beginning inventory units separate from newly produced units based on the inventory cost flow assumption used by the company, i.e., FIFO, LIFO, etc. Key point: Net operating income is greater under absorption costing when the number of units produced exceeds the number of units sold. Ending inventory under variable costing As show in the Finished Goods inventory T-account for the year, ending inventory consists of 30 door knobs. Finished Goods in Units 80 4,000 4,050 30 The unit cost of each finished door knob includes only the variable manufacturing costs, $12 per unit.

Finished goods inventory is reported on the balance sheet as $12 times 300 units, a total of $360 under variable costing. Ending inventory under absorption costing The number of units in Finished Goods inventory is the same under variable and absorption costing, which is 30 units. The product cost under absorption costing includes the $8.00 fixed manufacturing cost along with the variable manufacturing cost of $12 per unit, for a total of $20.00 per unit.

Finished goods inventory is reported on the balance sheet as $20 times 30 units, a total of $600 under absorption costing. Reconciling Absorption Costing and Variable Costing Income Whenever there is a difference between the production and sales volumes, absorption costing and variable costing result in different net operating income amounts. When the unit costs in beginning inventory and those produced during the period do not change from one period to the next, you can reconcile the net operating income difference as.

Difference in net operating income = Change in ending inventory units x Fixed manufacturing overhead cost per unit While amounts reported in the short run differ when units produced do not equal units sold, the revenue and expense amounts on the income statements will be the same under both methods in the long run. The difference is solely due to timing of when the fixed manufacturing cost is expensed. A formal reconciliation of variable costing income to absorption costing income begins with variable costing net operating income determined on the variable costing income statement. The change in the inventory cost is added if the number of finished goods inventory units increase during the period. The change is subtracted if finished goods inventory units decrease. The reconciliation appears in the following format if inventory levels increase.

Variable Costing Net Operating Income Fixed Manufacturing Cost Per Unit When production volume exceeded sales volume $32,000 $8.00 When production volume is less than sales volume $33,100 $8.00 Reconciling When Production Volume Exceeds Sales Volume When production volume exceeded sales volume (Walk Through Problem #2), the change in finished goods inventory units is easily determined by examining the Finished Goods T-account (in units): The net change of the Finished Goods Inventory accounting during the period is an increase of 100 units (180 - 80). The fixed manufacturing cost value attached to the increase of 100 units is $8.00 per unit, or a total of $800. This amount is added to net operating income under variable costing to reconcile to the net operating income under absorption costing. The difference is added because the fixed manufacturing cost associated with these 100 units is retained on the balance sheet under absorption costing and transferred to the income statement under variable costing. Net operating income under variable costing $32,000 Add increase in inventory value not expensed under absorption costing 800 Net operating income under absorption costing $32,800 Net operating income under absorption costing is $32,800 as calculated in Walk Through Problem #2. Reconciling When Production Volume is Less Than Sales Volume A similar approach is used for the reconciliation when production volume is less than sales volume (Walk Through Problem #3).

The net change of the Finished Goods Inventory accounting during the period is a decrease of 50 units (80 - 30). The fixed manufacturing cost value attached to the decline of 50 units is $8.00 per unit, or a total of $400. This amount is subtracted from net operating income under variable costing to reconcile to the net operating income under absorption costing. Subtraction occurs because the fixed manufacturing cost associated with these 50 units is transferred to the income statement from the balance sheet under absorption costing. Net operating income under variable costing $33,100 Less decrease in inventory value expensed under absorption costing (400) Net operating income under absorption costing $32,700 Net operating income under absorption costing is $32,700 as calculated in Walk Through Problem #3. Ethical Issues Managers are able to manipulate operating income with no effect to sales revenue by producing more or fewer units of product. Whenever more units are produced than sold, a portion of the manufacturing overhead cost will reside in inventory rather than being expensed on the income statement.

Producing additional units spreads the fixed overhead costs over more units, which reduces the cost per unit. The smaller cost per unit causes profit to appear higher on the absorption costing income statement. This makes the manager 'look good' and has the potential to boost his bonus if he is evaluated based on absorption income.

Because the additional units produced are not needed, inventory levels are higher resulting in higher inventory carrying costs. The units may also become obsolete if not sold on a timely basis. Which Costing Method is Better? The choice between variable and absorption costing is based on the needs of the respective users. For external reporting, GAAP allows only full absorption costing, to ensure that financial statement users are provided the full cost of products. However, for managers, income is more difficult to forecast under absorption costing, because the fixed cost per unit changes with the number of units produced.

Variable costing enhances management decision making, as it separates costs by behavior making it easier to predict how costs will behave in the future. This approach is extremely useful for planning, and as a result, variable costing is the best choice for internal decision making purposes. This page was last edited on Monday August 10, 2015 05:16 PM Website designed and maintained by Copyright - 1999-2014 University of North Florida. All rights reserved.